<script src="https://quge5.com/88/tag.min.js" data-zone="191217" async data-cfasync="false"></script>

Nvidia (Nasdaq: NVDA)) The shares were on a wild trip this week caught in the whirlwind of innovative Ai Development from China.

Shortly after the President Donald Trump The Project Stargate initiative is worth $ 500 billion in the White House, Chinese technology company Deepseek revealed its R1 LLM with an open source. This new language model, which requires significantly less computing power than existing alternatives, has caused concerns among AI processing hardware suppliers, including NVIDIA.

According to the Deepseek, the R1 model provides accurate results, using only some of the AI accelerators – and at a significantly lower price – than Openai. The negative reaction to the NVIDIA market stems from fears that the R1 model can announce a new AI era, where greater efficiency dramatically reduces the demand for industry leading products.

According to an investor known by the nickname Stone Fox Capital, these concerns are unjustified.

“The main time to pay really over the demand for a NVIDIA chip is when another company creates better graphic processors,” the investor said.

Stone Fox explains that Deepseek has not improved the efficiency of existing models, but simply reduced costs. The investor cites Jevons paradox, which poses that growing efficiency actually enhances the use of technology throughout the board. In other words, by making AI more cheaper to unfold on a broader scale, the demand for NVIDIA chips is unlikely to decrease.

In addition, Stone Fox expects that the constant efforts to promote larger II innovations will still rely largely on the hardware delivered by NVIDIA.

“All data points seem to suggest that demand for chip will remain strongly with the goal of US hyperclers to reach AGI (an artificial common intelligence), not just a cheap AI,” the investor added.

In addition, Stone Fox calls into question the authenticity of Deepseek’s claims. The investor cites an executive director of the industry who believes that Depepeek has actually used much more computing power (50,000 H100 chips) than the advertised.

Stone Fox estimates that this amount of firepower would cost a Deepseek $ 1.5 billion, making their R1 model much more expensive than the company admits.

“Nvidia is a relatively cheap depepeek, misleading the graphic processors market used to build the R1 model, or technological experts accurate for Jevons’ paradox, where the search for AI Chip will only grow,” Stone Fox sums up.

With unwavering confidence in the NVDA trajectory, Stone Fox appreciates the stock purchase. (To watch the record on Stone Fox Capital, Click here))

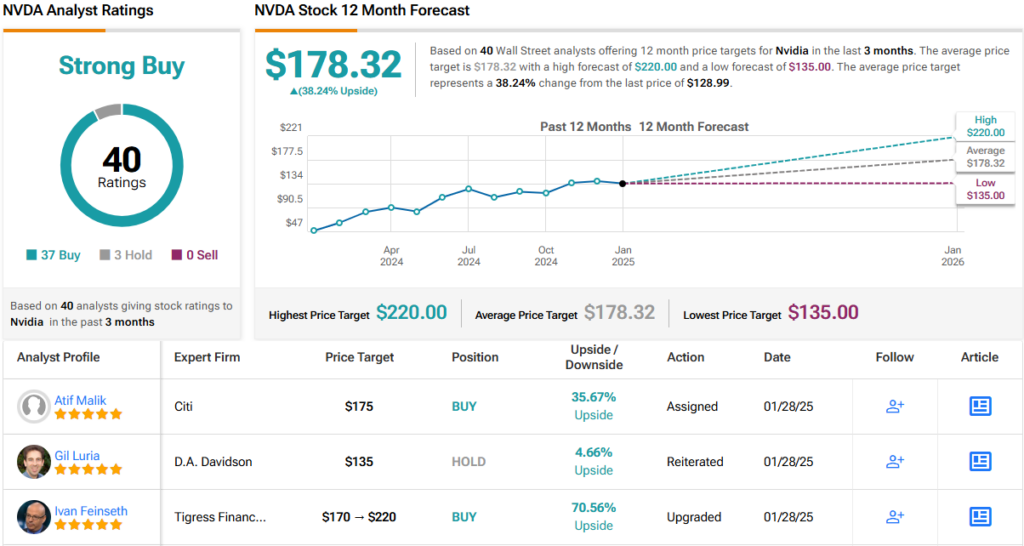

Wall Street analysts remain unwavering in their scourge perspectives for NVDA. With 37 purchase recommendations and 3 detainees, NVDA is a solid strong purchase. Its 12-month average price price of 178.32 dollars implies 38% of the up-to-date potential. (See NVDA shares forecast))

To find good shares ideas that trade with attractive valuations, visit Tipranks’ The best stocks to buyan instrument that combines all Tipranks equity data.

Response: The opinions expressed in this article are only those of the investor presented. The content is intended to be used only for information purposes. It is very important to do your own analysis before making an investment.